Transforming A Fragile Startup Into An Antifragile One

The unfortunate consequence of antifragile meta-systems like biological and societal evolution is that its individual constituents are fragile. Individual organisms may wither (or prosper), or individual companies/technologies/ideas may fade (or flourish), but biological ecosystems and human societies as a whole are bound to be better than those of previous generations. Survival-of-the-fittest is a great property when zoomed out, but when you are that individual or company, it's quite ominous. Antifragile systems work because its constituents are fragile.

So rather than being a fragile individual startup, can you somehow borrow the properties of these antifragile meta-systems? In other words, can a startup mimic this process of biological/societal evolution such that its internals may consist of many zero-downside experiments that do the overall startup no harm, but with some unlimited upside experiments that lead to guaranteed prosperity over time? 1You may argue that a startup already satisfies these properties discussed. Yes, startups are already antifragile to a range of inputs. For example, in contrast with voting-mechanism systems like elections, where the sum of the upvotes must be greater than the sum of the downvotes, a company loses nothing by all the people who don't like or vehemently hate their product; they can only benefit from the ones that do. This results in convexity, rather than a typical averaging function, that enables antifragility. Nevertheless, there is still some range of inputs to which a startup is fragile to. Despite many capped-downside, unlimited-upside experiments, a startup can still fail. This article is about increasing the set of a startup's antifragile inputs. 2Note, we don't want to enable a startup's antifragility by transferring fragility from the individual to the system (See Atlas Shrugged). Instead, we want to enable antifragility independently, without affecting the system in which it operates.

Let's look at some examples. Amazon as a marketplace is already one such antifragile meta-system. Individual third-party companies may choose to sell their products on the platform, and most of them fail and wither, with no harm to Amazon the marketplace. But some third-party companies sell to a large portion of customers and capture asymmetric returns, a portion of which is delivered to Amazon, and improve the ecosystem as a whole, mimicking that of biological/societal evolution.

Airbnb is another example — as is virtually every marketplace. But this property isn’t exclusive to marketplaces. Take Stripe, for instance. Businesses can use their payments API for zero cost; only once they're generating revenue do they pay a portion (on the order of 1% of revenue) to Stripe. This performance-based pricing model gives Stripe's customer zero-downside, unlimited upside. It also gives Stripe a capped-downside, unlimited-upside model because for every customer that uses their API and fails to generate revenue, Stripe incurs negligible cost, and for each customer that outperforms, Stripe proportionally outperforms with it.

Compare this to a payment-provider that charges a monthly fee for using its API. The customer now has downside, and the payment-provider is capping its upside, which infringes on its ability to exploit the random, unexpected volatilities that usually make up most of the value.

So suppose you structured your startup as an antifragile ecosystem in its broadest sense: the internals of your company are an entire economy. It consists of many 5ish-person teams, each working on its own independent startup. The employees are salaried 3probably with equity in their startup to partake in the upside and improve the probability of success, most of the startups fail (which has a capped downside equal to the sum of the salaries), and some rare few startups succeed, such that their asymmetric returns more than offset the sum of the capped downsides. This is essentially how VCs operate.

But note that here, the capped-downside losses MUST be offset by the asymmetric returns. This results in more of a skewed weighted-average function than a true, nonlinear convex asymmetry. Contrast this to biological evolution: if an organism dies, there is effectively ZERO loss to the overall system. So the difference is that our startup-as-an-economy system has CAPPED-downside, unlimited upside, and biological evolution has ZERO-downside, unlimited upside. 4I suppose this isn't entirely the case. In biological evolution, the whole system can be described to have a total energy input, small pieces of which are 'consumed' by the individual constituents. If suppose all organisms died, the system would cease to exist. So biological evolution too needs some winners to offset the losses, so it too is a weighted average. However, the total energy input and total number of constituents is so large that each loss is effectively zero, rather than some capped non-zero value.

Amazon and Stripe fall under this ZERO-downside, unlimited upside category. When a new customer incorporates the Stripe API into their website for example, there is effectively zero cost to Stripe (the marginal increase in bits of memory, the marginal increase of the cost of serving the API docs webpages, the marginal cost of compute of test runs, etc). Stripe needs to guarantee only that the returns of winners exceed the fixed costs of maintaining the system as whole. So while Stripe and biological evolution have zero marginal costs and only a fixed cost to offset, our startup-as-an-economy has very much non-zero marginal cost (the salaries of the failed entrepreneurs) in addition to any fixed costs. Societal evolution works in this way too; there is a fixed cost for the laws that were written to create an evolutionary ecosystem, as well as the cost to the government to enforce them, but each individual new company that forms to solve a problem incurs no additional cost. 5I suppose this also isn't necessarily true; anytime an LLC is formed, the government does incur some cost in establishing it. But again, this cost is so small it is effectively zero. Then perhaps this is more about economies of scale than anything else. Nevertheless, we shall continue as there is some value that comes from these assumed approximations.

Now we also have to consider the other half of the equation before we can form the full picture, the level of upside.

In all these examples of existing companies that can partake in unlimited upside of its individual constituents (marketplaces like Amazon and Airbnb, Stripe, Shopify is another example), the common property is that the units of value these companies provide are in dollars, or some currency of money. Meaning, for a given customer, the inputs into their system is your product or service and the output is dollars. And only because that output, dollars, has the same unit as that which you are trying to maximize, you can use a performance-based pricing model and capture x% of the generated output, leading to uncapped upside.

On the other hand, if you sold software that improved one's productivity, or a video game that increased one's happiness, or anything that was not dollars, you could not easily devise a performance-based model and capture a percent of that output. There is no way to capture a percent of someone's happiness for playing a video game as payment for your product or service. As a result, you cannot partake in the potentially unlimited upside of your users and must use some standardized, value-to-price proxy model that caps your upside!

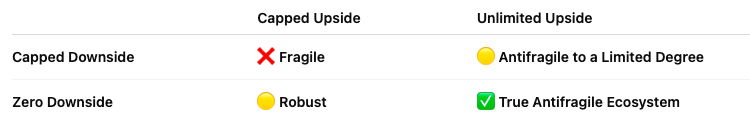

Thus, we have a 2x2 matrix of zero/capped downside and capped/uncapped upside.

The vast majority of companies fall into the capped-downside, capped-upside category. Only companies who deliver money as an output (ie companies that help other companies/people make money) will fall under the uncapped upside category. And only companies whose economies of scale allow for zero marginal cost can fall under the zero-downside category. As a result, we get this:

Although, isn't there something weird here? Sure it's true that I can't capture a portion of a user's happiness as payment for my product/service, or whatever other category of value we deliver (health, productivity, social status, etc). But anything of value, any measure of utility, can be converted into dollars — this is the purpose of currency after all. And if I were able to convert to its dollar equivalent my user's happiness from playing my video game, or the wide-ranging enhancements to my user's life from a weight loss + gym solution, or the gains in wealth and status and relationships from my productivity solution, then I could charge him 1-10% of whatever that dollar value is, allowing me to capture the potential, unexpected, completely asymmetric, uncapped, extraordinary customer upsides. And from the user's perspective, if he paid 1-10% of the value received, he would be getting a 10x-100x ratio of value received to price paid, with zero downside if it didn't work for him!

Performance-based pricing is an optimal model for all parties involved, but relies on your ability to 1) measure utility received from your service and 2) reliably convert that utility into a dollar amount.

Step 2 is a hard problem, a genuinely difficult function to find. But if you had step 1 solved, you can borrow the insight from machine learning that instead of painfully finding such a function, you can just amass many input-output examples (user's received value and their self-appointed dollar equivalent) and learn the function from supervised learning.

So the issue is in step 1, which frankly, I don't think we yet have the technology for. Throwing ideas out there, if you had some device that mounted your head and measured all your brain's neurochemical changes, along with some other device (a camera tied into AI Vision) to discern from what sources the value you receive is coming from, you'd have a solution. Short of that, there probably is a permutation of sensors you can wear, tied to some deep learning algorithm that can deduce the essence of your current state in a way that approximates what an ideal neurochemical tool would measure.

Glossing over the clear technical challenges, if you built such measurement, you could convert every single business and product into a performance-based, unlimited upside business model. Companies would plug into your device that is attributing and measuring value of each product to a given person's state. And of course, you would have a very straightforward, antifragile, uncapped upside, zero marginal cost, zero-downside, ecosystem-as-a-product that captures x% of each company's generated revenue.

Short of this ridiculous technology, if you have some pricing model where your output of value is currency, consider switching to a performance-based, uncapped upside model. If you deliver a product/service where the output value is not directly money, but is only a few indirect steps away from it (e.g. you sold some tool that saves people/companies time, and that time could be easily converted into a dollar amount, AND you had some way to measure how much time you were saving + what that dollar equivalent was), then you too could switch to an antifragile, uncapped upside, performance-based business model.

Email me at max@atnself.com if you have some thoughts (the temporary solution until I add comments).